What Is Liquidity?

As an investor, it’s important to understand the difference between liquidity and illiquidity when making investment decisions.

This measurement also plays a vital role when setting your investment budget and analyzing risk. Additionally, lenders oftentimes assess the liquidity of your assets when approving personal and business loans.

As mentioned above, liquidity represents how fast you can convert an asset, such as stocks and bonds, into readily available cash. However, for an asset to be liquid, you must not only be able to quickly convert it into cash, but the asset must also maintain its basic market value throughout the conversion. The easier and faster you can convert an asset into cash without impacting its market price, the more liquid the asset is.

Lenders as well as investors often analyze a company’s liquidity ratio before approving any type of business loan or making an investment. The liquidity ratio determines the company’s ability to convert its assets into cash in comparison to its debt obligations. While what’s considered an acceptable liquidity ratio varies greatly, most lenders and investors are looking for companies with a ratio of at least one.

As an investor, understanding the liquidity of a specific asset can help you make investment decisions. For example, if you’re a new investor, you may want to consider more liquid assets that can be easily converted to cash if necessary. This can help reduce the risk factor until you’re more comfortable with the investment process. Liquid assets can also provide a level of financial security in the event of a recession.

Most investors, however, prefer to build an investment portfolio that includes a combination of both liquid and illiquid assets. It’s important to understand that it may take longer to convert an illiquid asset into cash and you also may lose money on your investment by making this conversion too early.

Examples of liquidity

Cash, of course, is considered the most liquid of all assets. With cash, including your savings and checking accounts, no conversion is necessary. Rather, these funds are already fully available to you. The next type of liquid assets is cash alternative investments, such as CDs, treasury bills, and money market accounts.

For these assets, the liquidity of the investment ties into its terms. For example, you won’t reap the full benefits of your investment in a CD unless you hold it until the end of its term, which could be several months or years. Even though you may incur penalties for cashing these assets in before the end of the term, you can convert them into cash rather quickly, which makes them liquid assets.

Stocks and bonds are also considered liquid assets. However, the level of liquidity for these assets depends greatly on the type of stocks and bonds. For example, large-cap stocks are known for their high-trading volume, tight bid-ask spread and fast trade options. This combination makes these stock options highly liquid investments.

Other types of assets, such as real estate, art, collectibles, jewelry, and equipment are illiquid assets. These assets are more difficult to convert into cash because it takes more time to secure a buyer. Furthermore, if you need to sell them quickly, you’re likely to do so at a loss.

The two measures of liquidity

There are two primary ways to measure liquidity, market liquidity and accounting liquidity. Both methods of measuring liquidity are effective, but they serve very different purposes. Whether you’re an investor or business owner, it’s important to understand the difference between market and accounting liquidity.

Market liquidity

Market liquidity measures the efficiency of various markets to buy and sell assets. For example, you can measure a stock’s liquidity by how easy it is to buy and sell the stock at a stable price in its respective market.

High-liquid markets allow assets to be sold, traded and bought quickly and without causing a significant drop in price value. Low-liquid markets are the exact opposite. In these markets, it can be difficult to sell and buy assets or to do so without incurring a significant drop in the price of the asset.

If you’re looking for investment options that you can easily convert into cash, it may be ideal to look for those in high liquid markets.

Accounting liquidity

Rather than measure market efficiency, accounting liquidity measures a company’s ability to pay off its short-term debts. This measurement compares the company’s current assets against its current liabilities to determine a liquidity ratio. This ratio often serves as a good indicator of the overall financial health of a company.

Naturally, companies use this measurement to assess their own financial health. However, investors and lenders also use accounting liability when making investment decisions or loan approvals. While there are no specific standards for identifying a good accounting liquidity ratio, investors should look for companies that have a minimum ratio of one.

Are stocks liquid assets?

Many segments of the stock market, like the market for large-cap stocks, are considered to be highly liquid. This is for a variety of reasons, including:

- High trading volumes

- Relatively tight bid-ask spreads

- Fast trade execution

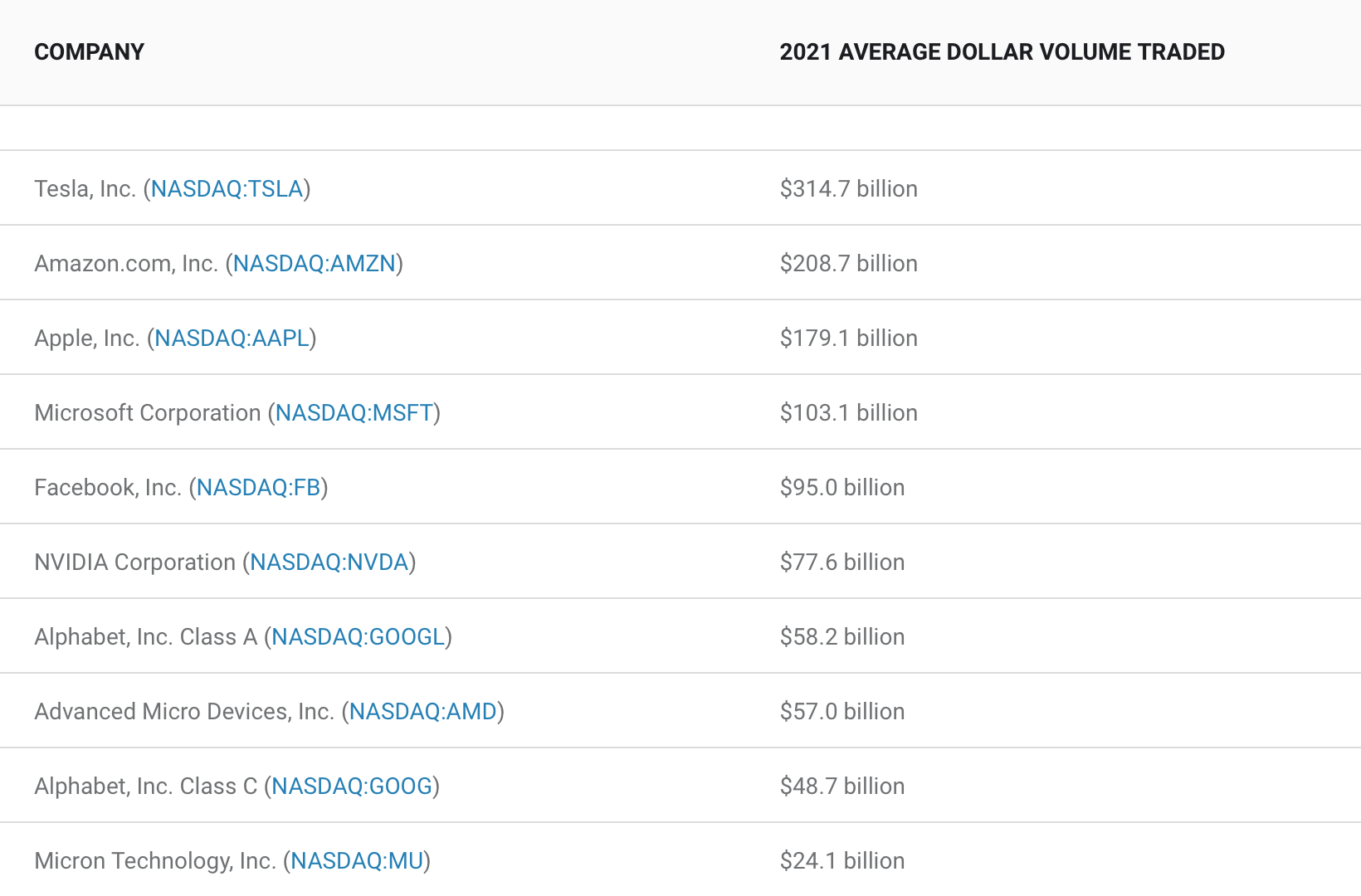

Among the large-cap universe of stocks are many household names known for high liquidity. Apple(NASDAQ:AAPL), Tesla (NASDAQ:TSLA), and Facebook (NASDAQ:FB) are all great examples of highly liquid stocks.

Penny stocks, which are stocks that trade for $5 or less, are known to be relatively illiquid. Penny stocks tend to be thinly traded, have wide bid-ask spreads, and may be slow to sell — particularly if you’re trying to unload a large number of shares.

How to determine a stock’s liquidity

Analyzing a stock’s liquidity is as much qualitative as it is quantitative. Your main considerations are:

- How narrow is the bid-ask spread?

- What is the average daily trading volume?

Using Starbucks (NASDAQ:SBUX) as an example, at the time of this writing, the bid-ask spread is a penny: $112.46-$112.47. This is an indication that the stock is extremely liquid, and a trade of any reasonable size does not impact the price.

Trading volume of at least 1 million shares daily is considered a sign of market liquidity. Starbucks’ average trading volume during the past three months has been just over 6.5 million — another sign that the market for Starbucks shares is highly liquid. Unless you’re trading a sizable number of shares (in the hundreds of thousands), you can consider Starbucks stock to be liquid.

Examples of liquid stocks

Below is a table of the 10 most liquid stocks, based on the average traded dollar volume:

What is accounting liquidity?

Accounting liquidity denotes the degree to which a company is able to pay its short-term obligations. (Short-term, in this context, is widely understood to mean 12 months.) Accounting liquidity is calculated by analyzing a company’s financial statements, and typically the following metrics are calculated:

- Current ratio: The current ratio is found by simply dividing a company’s current assets by its current liabilities. Current assets include cash and other assets the company expects to use or consume within a year, while current liabilities are the company’s debts due within the next 12 months.

- Quick ratio: To calculate a company’s quick ratio, add cash, marketable securities, and accounts receivable, and divide that sum by the company’s current liabilities. This measure is used to determine the degree to which a company can quickly settle its current debts using only its quickly accessible assets.

- Acid-test ratio: The acid-test ratio is another way to measure a company’s ability to quickly pay off its debts and is often calculated the same as the quick ratio. In another variation of the acid-test ratio, subtract the value of a company’s inventory from its current assets and divide that amount by the company’s current liabilities.

- Cash ratio: The cash ratio is simply a company’s cash balance divided by its current liabilities.

Why liquidity matters

A stock’s liquidity is mainly important because it indicates how easily investors can exit a position, while accounting liquidity helps investors gain a better sense of a company’s financial flexibility.

Understanding the liquidity of your portfolio is a key component of risk management. If you can easily convert your stock holdings into cash, then you can settle unexpected expenses, even if the stock market broadly declines.