What Is an Exchange-Traded Fund (ETF)?

An exchange traded fund, or ETF, is a basket of investments like stocks or bonds. Exchange traded funds let you invest in lots of securities all at once, and ETFs often have lower fees than other types of funds. ETFs are traded more easily too.

But like any financial product, ETFs aren’t a one-size-fits-all solution. Evaluate them on their own merits, including management costs and commission fees (if any), how easily you can buy or sell them, how they fit into your existing portfolio and their investment quality.

Understanding Exchange-Traded Funds

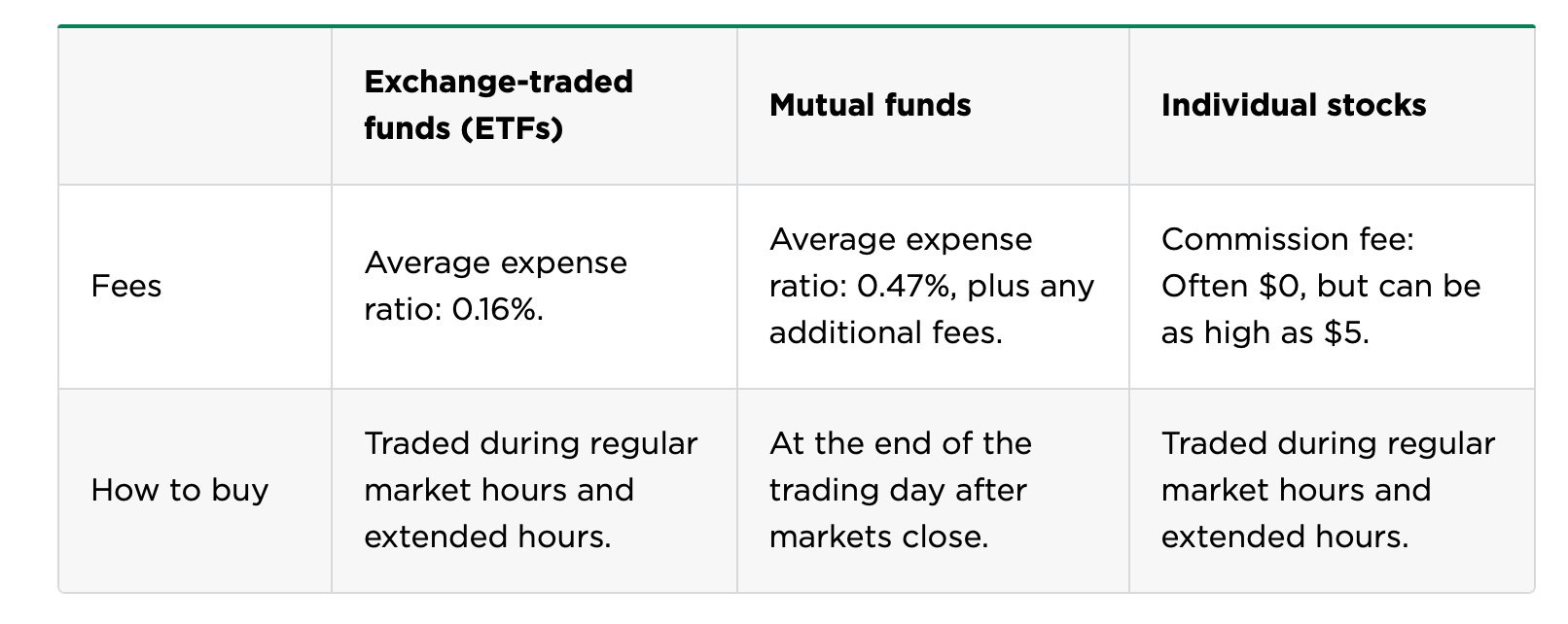

An ETF is called an exchange-traded fund because it’s traded on an exchange just like stocks are. The price of an ETF’s shares will change throughout the trading day as the shares are bought and sold on the market. This is unlike mutual funds, which are not traded on an exchange, and which trade only once per day after the markets close. Additionally, ETFs tend to be more cost-effective and more liquid compared to mutual funds.

An ETF is a type of fund that holds multiple underlying assets, rather than only one like a stock does. Because there are multiple assets within an ETF, they can be a popular choice for diversification. ETFs can thus contain many types of investments, including stocks, commodities, bonds, or a mixture of investment types.

An ETF can own hundreds or thousands of stocks across various industries, or it could be isolated to one particular industry or sector. Some funds focus on only U.S. offerings, while others have a global outlook. For example, banking-focused ETFs would contain stocks of various banks across the industry.

Types of ETFs

Exchange traded funds may trade like stocks, but under the hood they more resemble mutual funds and index funds, which can vary greatly in terms of their underlying assets and investment goals. Below are a few common types of ETFs — just note that these categories aren’t mutually exclusive. For example, a stock ETF might also be index-based, and vice versa. These ETFs aren’t categorized by management type (passive or active), but rather by the types of investments held within the ETF.

Stock ETFs

These comprise stocks and are usually meant for long-term growth. While typically less risky than individual stocks, they carry slightly more risk than some of the others listed here, such as bond ETFs.

Commodity ETFs

Commodities are raw goods that can be bought or sold, such as gold, coffee and crude oil. Commodity ETFs let you bundle these securities into a single investment. With commodity ETFs, it’s especially important to know what’s inside them — do you have ownership in the fund’s physical stockpile of the commodity, or own equity in companies that produce, transport and store these goods? Does the ETF contain futures contracts? Is the commodity considered a “collectible” in the eyes of the IRS? These factors can come with serious tax implications and varying risk levels.

Exchange-traded notes (ETNs)

Exchange-traded notes, or ETNs, are technically not ETFs, but are often confused with ETFs due to their similar name and characteristics. Like ETFs, ETNs trade on exchanges throughout the trading day — and like ETFs, they track a basket of assets. ETNs often track commodities, bonds, derivatives such as futures, or more exotic assets such as carbon credits, rather than stocks.

An ETN differs from an ETF in that it does not actually own the underlying assets — instead, it’s a debt security whose value is pegged to its underlying assets through some kind of formula.

What that means in practice is that an ETN’s value relies on the creditworthiness of its issuer, and the risk of an issuer default is worth considering when looking at ETNs.

Bond ETFs

Unlike individual bonds, bond ETFs don’t have a maturity date, so the most common use for them is to generate regular cash payments to the investor. These payments come from the interest generated by the individual bonds within the fund. Bond ETFs can be an excellent, lower-risk complement to stock ETFs.

International ETFs

Foreign stocks are widely recommended for building a diverse portfolio, along with U.S. stocks and bonds. International ETFs are an easy — and typically less risky — way to find these foreign investments. These ETFs may include investments in individual countries or specific country blocs.

Sector ETFs

The U.S. stock market is divided into 11 sectors, and each is made up of companies that operate within that sector. Sector ETFs provide a way to invest in specific companies within those sectors, such as the health care, financial or industrial sectors. These can be especially useful to investors tracking business cycles, as some sectors tend to perform better during expansion periods, others better during contraction periods. Often, these typically carry higher risk than broad-market ETFs. Sector ETFs can give your portfolio exposure to an industry that intrigues you, such as gold ETFs or marijuana ETFs, with less risk than investing in a single company.

Leveraged ETFs

Leveraged ETFs are exchange-traded funds that tracks an existing index, but rather than match that index’s returns, it aims to increase them by two or three times. Imagine you had a traditional ETF that followed the S&P 500. If the S&P 500 went up by 2%, your ETF would likely also increase by about 2% because it holds most of the same companies the index tracks.

If you had a leveraged S&P 500 ETF, that 2% gain could be magnified and instead be a 4% gain. While that’s great if the market is going up, it’s not so great if the market is going down. This is what makes leveraged ETFs riskier than other types of ETFs.

How do ETFs work?

Exchange traded funds work like this: The fund provider owns the underlying assets, designs a fund to track their performance and then sells shares in that fund to investors. Shareholders own a portion of an ETF, but they don’t own the underlying assets in the fund. Even so, investors in an ETF that tracks a stock index may get lump dividend payments, or reinvestments, for the stocks that make up the index. (Related: Learn how to invest in index funds, or compare index funds and ETFs.)

While ETFs are designed to track the value of an underlying asset or index — be it a commodity like gold or a basket of stocks such as the S&P 500 — they trade at market-determined prices that usually differ from that asset. What’s more, because of things like expenses, longer-term returns for an ETF will vary from those of its underlying asset.

Here is the abbreviated version of how ETFs work:

1. An ETF provider considers the universe of assets, including stocks, bonds, commodities or currencies, and creates a basket of them, with a unique ticker.

2. Investors can buy a share of that basket, just like buying shares of a company.

3. Buyers and sellers trade the ETF throughout the day on an exchange, much like a stock.

Jump to learn how to start investing in ETFs.

ETF creation and redemption

Given that ETF shares correspond to shares of a basket of assets, the process of creating or retiring ETF shares is complex — and has to involve a purchase or sale of the underlying assets.

To create new ETF shares, an “authorized participant” — typically an institutional investor like a broker — gives the ETF a basket of assets that match the ETF’s portfolio or a cash payment. In exchange, they receive a block of new ETF shares with the same value as this “creation basket.” The authorized participant then sells those new shares to regular investors.

To retire or “redeem” ETF shares, this process happens backward. The authorized participant returns a block of ETF shares to the fund, and in exchange receives a basket of cash, assets, or both that typically mirrors what a creation basket would be for that number of shares.

ETF advantages and disadvantages

ETF pros

Investors have flocked to exchange traded funds because of their simplicity, relative cheapness and access to a diversified product. Here are the pros:

Diversification

While it’s easy to think of diversification in the sense of the broad market verticals — stocks, bonds or a particular commodity, for example — ETFs also let investors diversify across horizontals, like industries. It would take a lot of money and effort to buy all the components of a particular basket, but with the click of a button, an ETF delivers those benefits to your portfolio. Diversification can help safeguard your portfolio against market volatility. If you invested in just one industry, and that industry had a really bad year, it’s likely your portfolio would have performed poorly too. By investing across different industries, company sizes, geographies and more, you give your portfolio more balance. Because ETFs are already well-diversified, you don’t have to worry about creating it within your portfolio.

Transparency

Anyone with internet access can search the price activity for a particular ETF on an exchange. In addition, a fund’s holdings are disclosed each day to the public, whereas that happens monthly or quarterly with mutual funds. This transparency allows you to keep a close eye on what you’re invested in. Say you really don’t want to be invested in oil. You’d be able to spot those additions to your ETF more easily than with a mutual fund.

Tax benefits

ETFs have two major tax advantages over mutual funds.

If you invest in a mutual fund, you may have to pay capital gains taxes (or, the profits from the sale of an asset, like a stock) through the lifetime of your investment. This is because mutual funds, particularly those that are actively managed, often trade assets more frequently than ETFs. Most ETFs, on the other hand, only incur capital gains taxes when you go to sell the investment. This means you’ll pay less tax on your ETF investment overall.

As mutual fund managers are actively buying and selling investments, and incurring capital gains taxes along the way, the investor may be exposed to both long-term and short-term capital gains tax. If you’re invested in an ETF, you get to decide when to sell, making it easier to avoid those higher short-term capital gains tax rates.

ETF cons

Exchange traded funds may work well for some investors, but they aren’t perfect. Here are the cons:

Trading costs

ETF costs may not end with the expense ratio. Because ETFs are exchange-traded, they may be subject to commission fees from online brokers. Many brokers have decided to drop their ETF commissions to zero, but not all have.

Potential liquidity issues

As with any security, you’ll be at the whim of the current market prices when it comes time to sell, but ETFs that aren’t traded as frequently can be harder to unload.

Risk the ETF will close

The primary reason this happens is that a fund hasn’t brought in enough assets to cover administrative costs. The biggest inconvenience of a shuttered ETF is that investors must sell sooner than they may have intended — and possibly at a loss. There’s also the annoyance of having to reinvest that money and the potential for an unexpected tax burden.

How much do ETFs cost?

Exchange traded funds can vary significantly when it comes to cost. The median price of the most popular ETFs by trading volume is $59.42. The most expensive ETF in that list tops out at $473.56 and the lowest comes in at $3.43. That range may feel intimidating, but it also means there is an ETF for every budget. It may help to outline how much you’re willing to spend on an ETF before you dive in.

When researching ETFs you’ll also need to consider the fund’s expense ratio, or the fee the fund charges to manage and maintain it. Because most ETFs are passively managed, ETF expense ratios are typically pretty low compared with other types of funds.

ETF examples

For all their simplicity, exchange traded funds have nuances that are important to understand. Armed with the basics, you can decide whether an ETF makes sense for your portfolio, embark on the exciting journey of finding one — or several.

There are lots of great ETFs out there, but here are a few picks from our list of the top-rated ETFs.

- SPDR S&P 500 ETF (SPY)

- BNY Mellon US Large Cap Core Equity ETF (BKLC)

- SoFi Select 500 ETF (SFY)

- JP Morgan Betabuilders U.S. Equity ETF (BBUS)

- iShares Core S&P 500 ETF (IVV)

ETFs vs. mutual funds vs. stocks

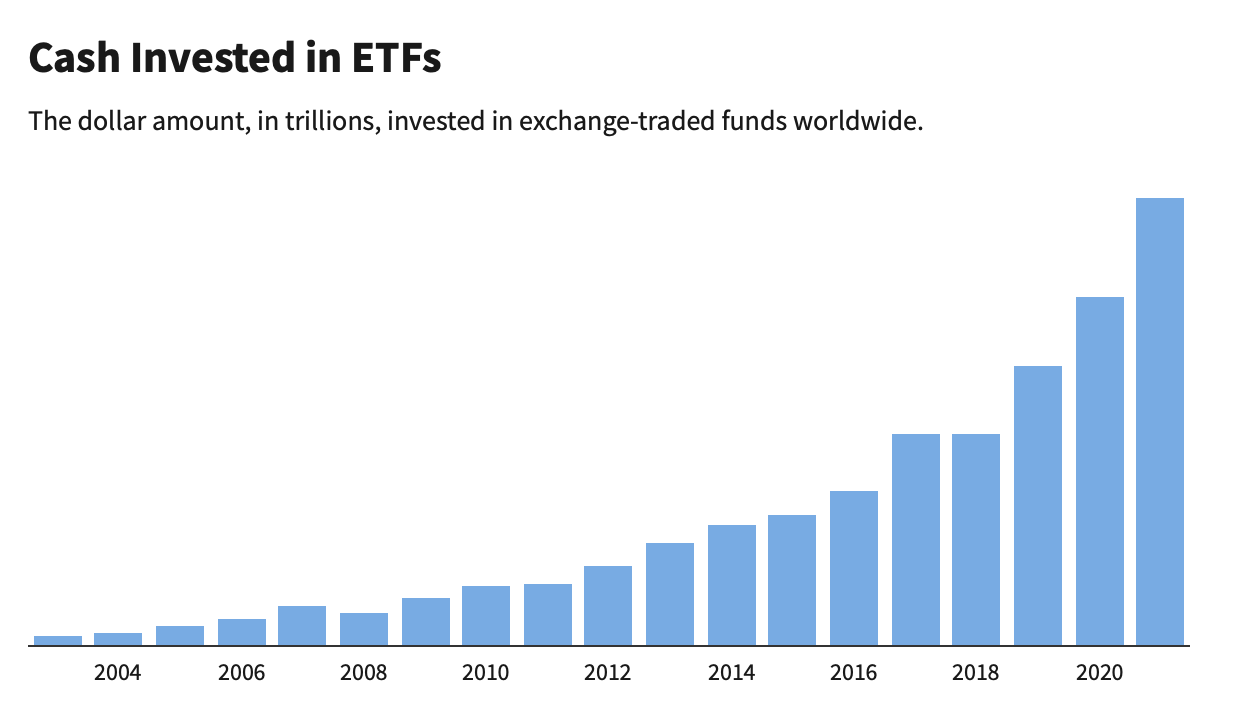

When comparing exchange traded funds with other investments, ETFs stand out in a number of ways. Lower investment costs, better diversification and an increasing number of options are just a few of the benefits of ETFs.

ETFs vs. mutual funds

Generally speaking, ETFs have lower fees than mutual funds — and this is a big part of their appeal.

ETFs also offer better tax-efficiency than mutual funds. There’s generally more turnover within a mutual fund (especially those that are actively managed) relative to an ETF, and such buying and selling can result in capital gains. Similarly, when investors go to sell a mutual fund, the manager will need to raise cash by selling securities, which also can accrue capital gains. In either scenario, investors will be on the hook for those taxes.

The two products also have different management structures (typically active for mutual funds, passive for ETFs, though actively managed ETFs do exist).

ETFs vs. stocks

ETFs are made up of stocks, but there is no such thing as an “ETF stock.” You can purchase a share of an ETF, but you cannot purchase stock in an ETF. ETFs are made up of individual stocks and other investments.

Like stocks, ETFs can be traded on exchanges and have unique ticker symbols that let you track their price activity. Unlike stocks, which represent just one company, ETFs represent a basket of stocks. Since ETFs include multiple assets, they may provide better diversification than a single stock. That diversification can help reduce your portfolio’s exposure to risk.

ETFs are sometimes focused around certain sectors or themes. For example, SPY is one of the ETFs that tracks the S&P 500, and there are fun ones like HACK for a cyber-security fund and FONE for an ETF focused on smartphones.

Here are a few of the key differences between ETFs, mutual funds and stocks.

How to find the right ETFs for your portfolio

It’s important to be aware that while costs generally are lower for ETFs, they also can vary widely from fund to fund, depending on the issuer as well as on complexity and demand. Even ETFs tracking the same index have different costs.

Most ETFs are passively managed investments; they simply track an index. Some investors prefer the hands-on approach of mutual funds, which are run by a professional manager who tries to outperform the market. There are actively managed ETFs that mimic mutual funds, but they come with higher fees. So consider your investing style before buying.

The explosion of this market also has seen some funds come to market that may not stack up on merit — borderline gimmicky funds that take a thin slice of the investing world and may not provide much diversification. Just because an ETF is cheap doesn’t necessarily mean it fits with your broader investment thesis.

How to invest in ETFs

There are a variety of ways to invest in exchange traded funds, and how you do so largely comes down to preference. For hands-on investors, investing in ETFs is but a few clicks away. These assets are a standard offering among the online brokers, though the number of offerings (and related fees) will vary by broker. On the other end of the spectrum, robo-advisors construct their portfolios out of low-cost ETFs, giving hands-off investors access to these assets. One trend that’s been good for ETF shoppers — many major brokerages dropped their commissions on stock, ETF and options trades to $0.

1. Open a brokerage account

If you’re ready to start investing in ETFs on your own, you’ll need to have a brokerage account to do so. Brokerage accounts are where your investments live; just because you have one does not mean you’re invested in anything. After you open an account you can invest in ETFs from there.

If you need help, you can work with a robo-advisor or a traditional financial advisor.

2. Find the ETFs you want to invest in

This isn’t as complicated as it sounds, but there are lots of ETFs on the market, and it can be tricky narrowing it down. You can use online screeners to help you find ETFs with low costs, funds in particular sectors or ETFs that have a socially responsible or environmental focus.

3. Buy the ETF

Using your brokerage’s trading function, navigate to the particular ETF you’d like to buy and place the trade. Make sure you double-check your order before you make it official.

4. Hold onto the ETF

How long you hold onto an ETF will depend on your investment strategy, but if you’re investing for retirement, it’s often a waiting game: The longer you hold it the better. Because of the nature of compound interest, the longer you hang onto an ETF the longer your interest will be accruing interest. You can use an investment calculator to estimate how much you can earn over different holding periods.

If you have a long investment timeline you’ll likely also be able to ride out the highs and lows of the stock market as it trends upward over time.

Do ETFs pay dividends?

Yes, as long as the underlying stocks held within the ETF pay dividends. These companies’ dividends are collected by the ETF issuer and distributed to investors, typically quarterly, based on the number of shares the investor owns in the ETF. However, if none of the underlying companies in the ETF offer dividends, the ETF won’t pay dividends, either. Some ETFs are constructed specifically to maximize dividend income, known aptly as dividend ETFs.

Can you sell an ETF at any time?

Yes. Just like stocks, ETFs can be bought or sold at any time throughout the trading day (9:30 a.m. to 4 p.m. Eastern time), letting investors take advantage of intraday price fluctuations. This differs from mutual funds, which can only be purchased at the end of the trading day, for a price that is calculated after the market closes.